On November 28, 2012, an event of unprecedented significance occurred in the world of cryptocurrency: the first Bitcoin halving. It was on this day that the reward per block for mining Bitcoin was reduced from 50 to 25 Bitcoins. This event, now a key part of Bitcoin’s economic policy, was programmed into the Bitcoin protocol by its mysterious and enigmatic creator, Satoshi Nakamoto, as a way to manage the supply of Bitcoins and combat inflation.

To fully grasp the weight of this event, it’s important to first understand Bitcoin mining and the concept of “halving.”

Bitcoin Mining and Block Rewards

Bitcoin mining is the process where new Bitcoins are generated. Miners use powerful computers to solve complex mathematical problems. The first one to solve the problem gets the opportunity to add a new block to the Bitcoin blockchain and receives a certain number of Bitcoins as a reward – this is known as the block reward.

When Bitcoin was first launched in 2009, this block reward was set at 50 Bitcoins. For every new block added to the blockchain (approximately every 10 minutes), the successful miner received 50 new Bitcoins. This served as a significant incentive for miners to participate in the network and validate transactions.

The First Halving

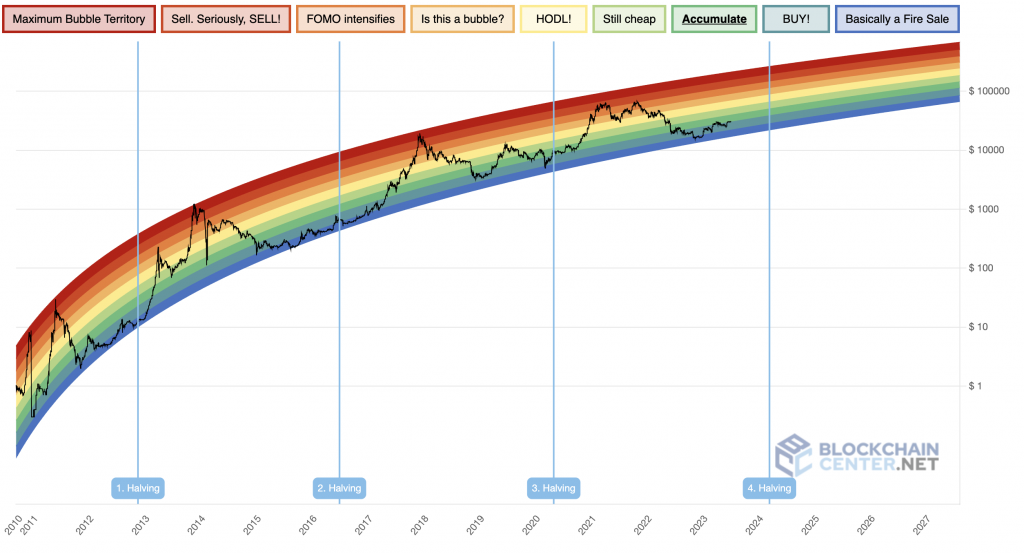

However, as designed by Nakamoto, this block reward does not remain constant. Instead, every 210,000 blocks – approximately every four years – the block reward is halved in an event known as a Bitcoin halving.

So, on November 28, 2012, the Bitcoin network reached its 210,000th block, triggering the first ever halving event. The block reward was reduced from 50 Bitcoins to 25, effectively halving the rate at which new Bitcoins were created and entered the economy. This event was a significant milestone in the history of Bitcoin.

Impact and Significance

The impact of the first halving was substantial. By reducing the reward, the halving effectively limited the supply of new Bitcoins entering the market. This scarcity effect, coupled with a steadily increasing demand for Bitcoins, led to a long-term rise in Bitcoin’s price.

To give you an example, on the day of the first halving, Bitcoin was trading around $12. By November 2013, just a year after the halving, the price had risen to over $1,000. While there were certainly other factors at play, the reduced supply of Bitcoins resulting from the halving event contributed significantly to this price increase.

Bitcoin’s halving events serve to highlight the cryptocurrency’s deflationary nature and its contrast with traditional fiat currencies, which can be printed at will by central banks. The halving events underscore Bitcoin’s pre-programmed scarcity, a feature that has helped it earn its moniker as ‘digital gold’.

Conclusion

In conclusion, November 28, 2012, marked a significant turning point in the history of Bitcoin, with the cryptocurrency experiencing its first ever halving event. The block reward reduction from 50 to 25 Bitcoins led to a decrease in the rate at which new Bitcoins were minted, increasing the digital currency’s scarcity, and contributing to its long-term price increase. It also served as a stark illustration of Bitcoin’s controlled supply mechanism, setting it apart from traditional, inflation-prone fiat currencies. The first Bitcoin halving, thus, is a milestone worth remembering in the evolution of cryptocurrency.